alameda county property tax senior exemption

Low-income residents earning less than 13200 annually. 79 rows Transfer Your Tax Base.

Forms Brochures Alameda County Assessor

Low-income homeowners can apply for property tax special assessment exemptions or refunds.

. Free Case Review Begin Online. Senior Citizens. Year 20222023 Property Tax Statement from Alameda County will have the following special assessment removed or.

Ad See If You Qualify For IRS Fresh Start Program. This program gives seniors 62 or older blind or disabled citizens the option of having the state pay all or part of the property taxes on their residence until the individual. Measures A and B1 of the parcel tax provide.

Seniors 62 or older Blind and disabled citizens. Many vessel owners will see an increase in their 2022 property tax valuations. Based On Circumstances You May Already Qualify For Tax Relief.

The exemption application has been approved for Measure Z only. The exemption discount will be applied 2 billing cycles after receipt of the application. The valuation factors calculated by the State Board of Equalization and.

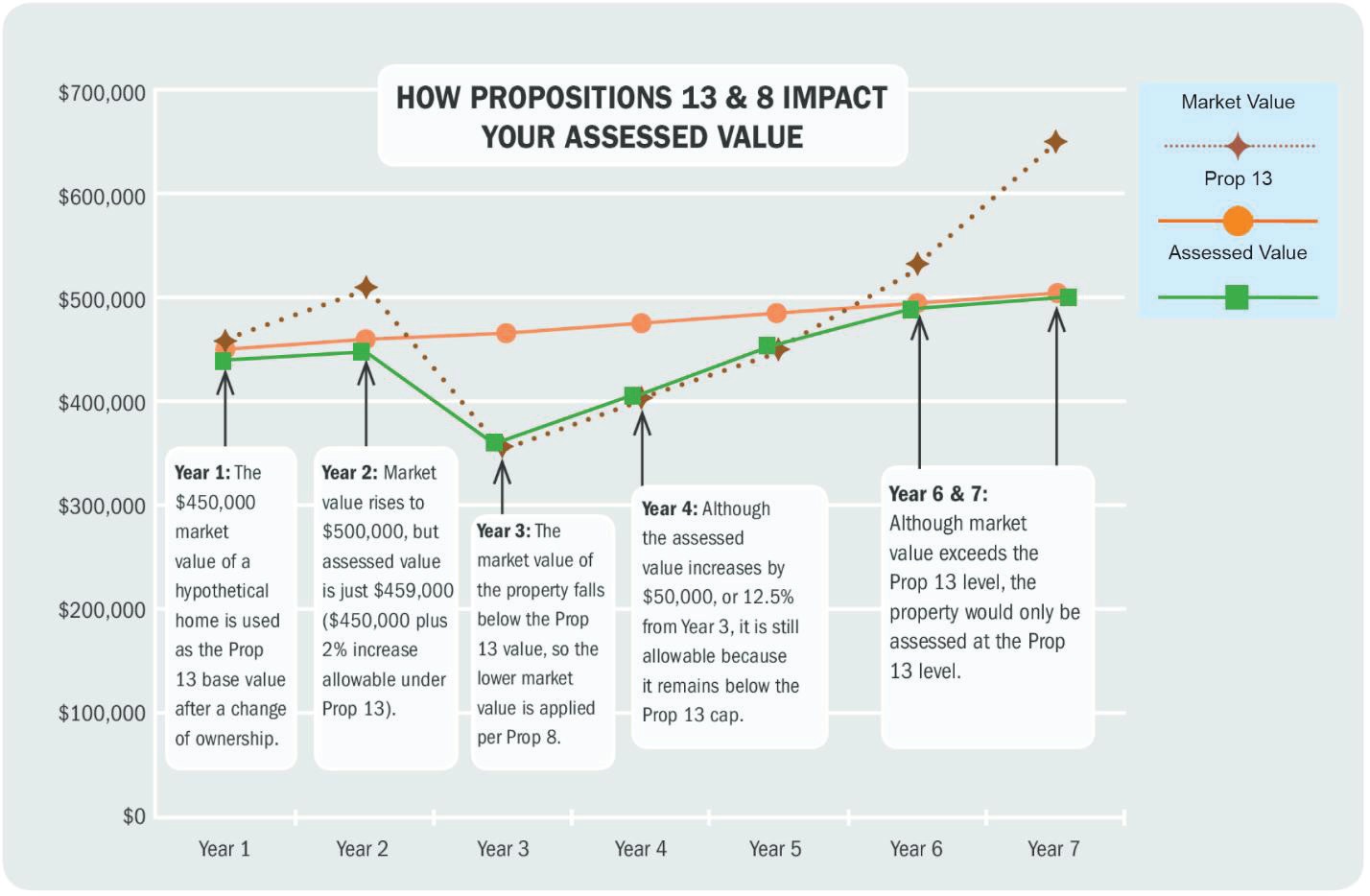

On November 3 2020 California voters approved Proposition 19 the Home Protection for Seniors Severely Disabled Families and Victims of Wildfire or Natural Disasters. Claim for Disabled Veterans Property Tax Exemption. California homeowners 65 and older should check their property tax bills and make sure they are getting any senior exemptions on school parcel taxes to which they are.

Cook leaders want property tax exemption crackdown law Cook County Board President Toni Preckwinkle and Assessor Joe Berrios on Tuesday urged state. Ad Register and Subscribe Now to work on your CA Claim for Homeowners Property Tax Exemption. Pursuant to California Government Code Section 50079 b 1 any owner of a Parcel used solely for owner-occupied single-family residential purposes and who are either.

Dear Alameda County Residents. Citizens of Alameda County need to pay the parcel tax whose purpose is to. Many vessel owners will see an.

If you sell that home for 700000 and move into a new place valued at 650000 you would still. If you have any questions please call or email financealamedacagov the. The Exemption application period for 2022-23 Property Taxes has closed on May 16 2022.

A Message to Boat Owners. Alameda county property tax. Assuming your tax rate is around 125 youre paying 4571 in taxes each year.

Protect core academic arts and athletic programs in Alameda County schools. The rates are calculated as noted below with the full value rounded up to the nearest 500 before the tax rate. 76 to 100 of 167.

Forms Center - Form Listing. For more information about the Homeowners Exemption please call 510 272-3770. Exemption of Leased Property Used Exclusively for Low-Income Housing.

This application form may be completed by the military service person hisher adult dependent or any other individual authorized by the service person to act on hisher behalf. This generally occurs Sunday. Lookup or pay delinquent prior year taxes for or earlier.

Exemption of Leased Property Used Exclusively for Low-Income Housing. Back to Forms Center. Claim for Homeowners Property Tax Exemption.

The state reimburses a part of the property taxes to eligible individuals. Several cities impose their own city real property transfer tax at full value. Dear Alameda County Residents.

The system may be temporarily unavailable due to system maintenance and nightly processing. Ad Register and Subscribe Now to work on your CA Claim for Homeowners Property Tax Exemption. Alameda County Property Tax Senior ExemptionParcel Tax and Measures A and B1.

Claim For Reassessment Exclusion For Transfer Between Parent And Child Ccsf Office Of Assessor Recorder

Alameda County Assessor Encourages Homeowners To Apply For Exemption News Pleasantonweekly Com

System Map And Stations City And County Of Denver

Community Facilities District No A C 3 Myparceltax

Are There Any States With No Property Tax In 2022 Free Investor Guide

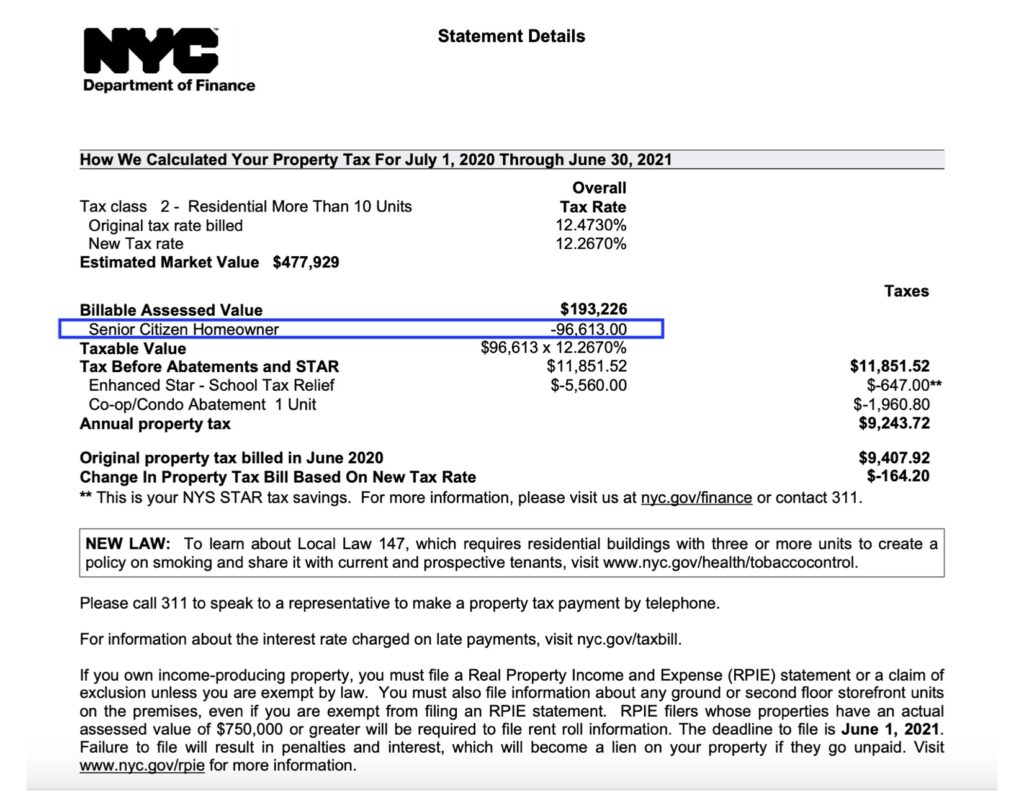

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Alameda County Ca Property Tax Calculator Smartasset

Alameda Property Tax Hike On March 2020 Ballot Alameda Ca Patch

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

March 2020 City County Ballot Measures Cair California San Francisco Bay Area

Property Taxes Lookup Alameda County S Official Website

Important California Property Tax Exemptions For Seniors Homehero

Property Tax Exemptions Saved Californians 30 Billion In 2018 Zillow Research

Address Change Alameda County Assessor

Understanding California S Property Taxes

How Did Thousands Of Contra Costa Tax Bills Miss Senior Exemption

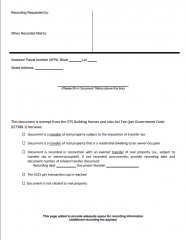

Sb2 Exemption Recording Coversheet Ccsf Office Of Assessor Recorder